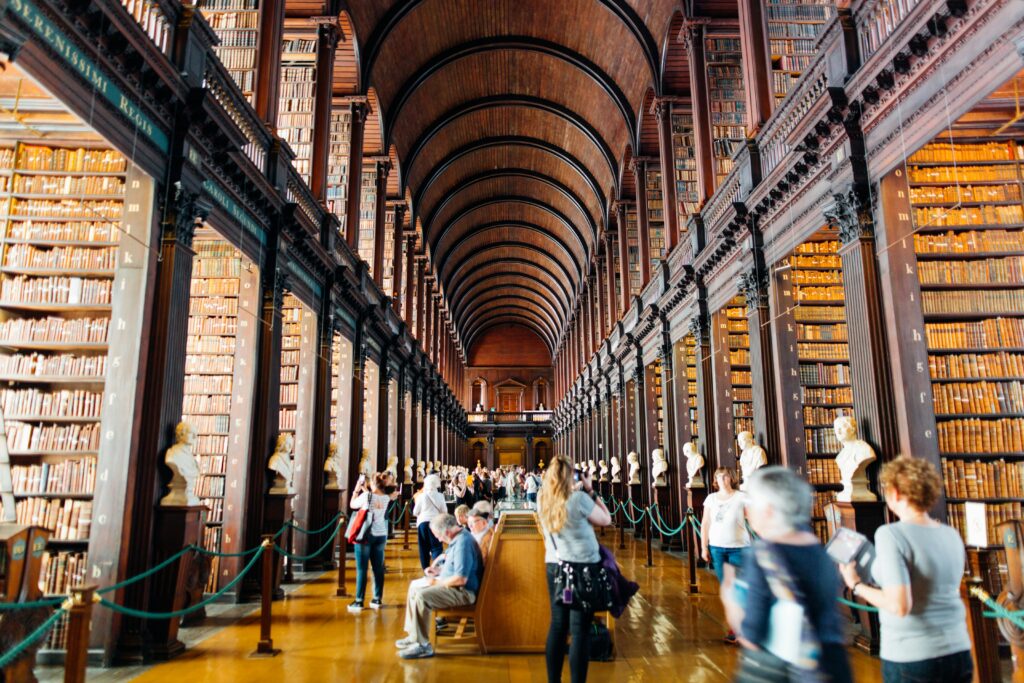

education program

The best place to gain a financial education.

The biggest reason why people struggle is because they haven’t been taught how to do better. Take control of your financial life today!

Best top notch features we provide to you

Online Certifications

Qualified Instructors

6 Different Categories

Experienced Members

15.2 K+

Impressions

5+ Years

Of Experience

introduction

Need guidance? Book a quick Consultation.

With our dedicated team of experts, you can get support that is tailored to your unique situation.

Our community

Connect with the group!

Online remote learning

Online remote learning

Get extra content

Get extra content

Expert qualified teachers

Expert qualified teachers

Valid certifications

Valid certifications

Video learn platform

Video learn platform

Course guidelines

Course guidelines

Top Features

✓ Support

✓ Engagement

✓ Networking Opportunities

MOST POPULAR COURSES

Pick a course to get started

on your journey.

FINANCE

Free

Basic Financial Concepts

Learn financial concepts that every person should know. From debt elimination to interest. It’s easy!

By Yeriel Martinez

(Not Yet Rated)

(Not Yet Rated)

LAW

Fees :

$99

Fair Debt Collection Practices Act (FDCPA)

Learn laws that protect people from deceptive practices by debt collectors.

By Yeriel Martinez

(Not Yet Rated)

(Not Yet Rated)

BUSINESS

Free

Understanding Business Credit

Learn what makes business credit and what builds a relationship with your business suppliers and lenders.

By Yeriel Martinez

(Not Yet Rated)

(Not Yet Rated)

15+

Financial Literacy Courses

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

recent insights

Checkout our latest news &

upcoming blog posts

Which bank should I use?

It’s our belief that the best banks to use are Credit Unions in your area. Credit unions are known for being a greater help to consumers than national banks. Check out our free course on banks!

What are your operating hours?

We are open from 9 AM to 7 PM EST, Monday to Friday. On Saturday we open from 10 AM to 5 PM. We’re closed on Sundays. Holiday hours may vary.

What’s the difference between FICO and Vantage 3.0 credit scores?

FICO and Vantage are both credit scoring models used to check creditworthiness but have different scoring criteria.

FICO is more widely used by lenders and focuses on factors like payment history and credit utilization.

Vantage is a newer scoring model, and it’s not as widely adopted as FICO. It can be more flexible in how it treats certain credit behaviors.

Check out the free course to learn more!

How long do negative items stay on my credit report?

Most negative items will fall off of your report after 7 years, although it could take as long as 10 years.

How much should I save for retirement?

The amount is different for everyone so in order to find out how much you need. You must speak with a financial advisor. They will tell you what’s your Financial Independence Number (FIN).

Got any more questions?

Why not send us an email? info@whyconsumercounseling.org

Please have the subject line as Question.